Colorado Springs Utilities Rates Are Increasing in 2026: What You Need to Know

CSU rates rise in 2026 with new Energy Wise time-of-use pricing. See what’s changing and how solar can help control energy costs. Learn more.

The advantages and benefits provided by solar energy are not limited to protecting the environment only. In fact, various economic advantages and solar tax incentives come along with adding a residential or commercial solar system to your home or business.

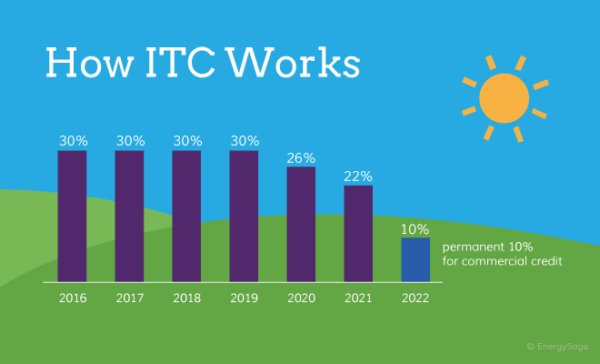

You can always claim your federal solar investment tax credit (ITC) for up to 26% of the total cost of your solar panel system on your federal incomes taxes. The year in which you install your solar panels is the year you can relish in this tax credit. To make it easier for you to understand, the tax credit you collect from your solar panels is the amount reduced from your federal incomes tax and the best part is, there are no limitations to how much tax credit you receive!

Even though the tax credit remains 26% throughout the year 2020, the percentage has been predicted to drop every following year. This means, by 2021 it will drop to 22%. It has been announced that only a tax credit of 10% will be given to commercial solar arrays! Unfortunately, by 2022 residential tax credits will not be entertained.

You should be eligible for this federal tax credit if you install a solar panel system between 1st January and 31st December, in the same year as your proposed tax year. It is not necessary for your solar panel system to be entirely installed and function perfectly for you to receive and enjoy your tax credit. You are legally eligible to claim your tax credit in the same year in which the structuring has started on your installation.

However, it is important for the solar array system to be owned by you in order to claim your tax credit. It is not possible for you to receive a tax credit if your solar panel system is rented. Even though you can claim the tax credit once, you can claim the credit until you own the system.

Coming straight to how you can actually claim your tax credit; it is when you file federal taxes at the end of the year you can claim your solar panel array investment tax credit. All you have to do is give a heads up and notify your tax professional about your solar system and carefully mention all the other related expenditure cost while the installation construction process. The tax professional will then return your investment tax credit information. In case you are not in contact with any tax professional to take in account your taxes and handle them, it is highly suggested that you take some time out and complete your research. Once you have all the necessary information regarding the data required to be submitted by the IRS you can confidently handle your own taxes.

Just for a quick reminder; you are running short on time to install a solar panel system and to enjoy the benefit of earning a tax credit up to 26% by the end of 2020! In order to prevent you from missing out on this amazing experience, we have decided to offer you a free of cost solar consultation with a professional solar expert! So without wasting any further time, quickly switch to solar energy systems and enjoy receiving your tax credit.

Contact us today to schedule your Free Customized Solar Consultation!

CSU rates rise in 2026 with new Energy Wise time-of-use pricing. See what’s changing and how solar can help control energy costs. Learn more.

MVEA electric rates increase 8.5% in 2026. Learn what’s driving the hike, how it affects your utility bill, and how solar can help you stabilize costs.